Spot and avoid scams

How to avoid scams

If it sounds too good to be true, it probably is. Be extremely cautious of investment offers that guarantee a high return.

Should you receive an unexpected message via email, SMS, WhatsApp, Facebook, or LinkedIn, even if it’s from someone you know, be careful when opening any links or attachments. It might be best to avoid responding to the message but don’t share any personal information if you do.

When opening links, take note of the structure of the link. If the spelling, domain, or anything in the link doesn’t seem right, verify them by independently searching the website or the business name.

If you’ve witnessed a scam that uses Sanlam or our adviser network, report it and seek assistance by contacting Sanlam's Client Care Centre +27 860 726 526.

What to look out for

Urge money transfers to unfamiliar accounts

Demanding upfront payments

Contain language errors

Promise rapid, high returns

Suspicious or unusual email addresses

Pressure you to act quickly

Scams to watch out for

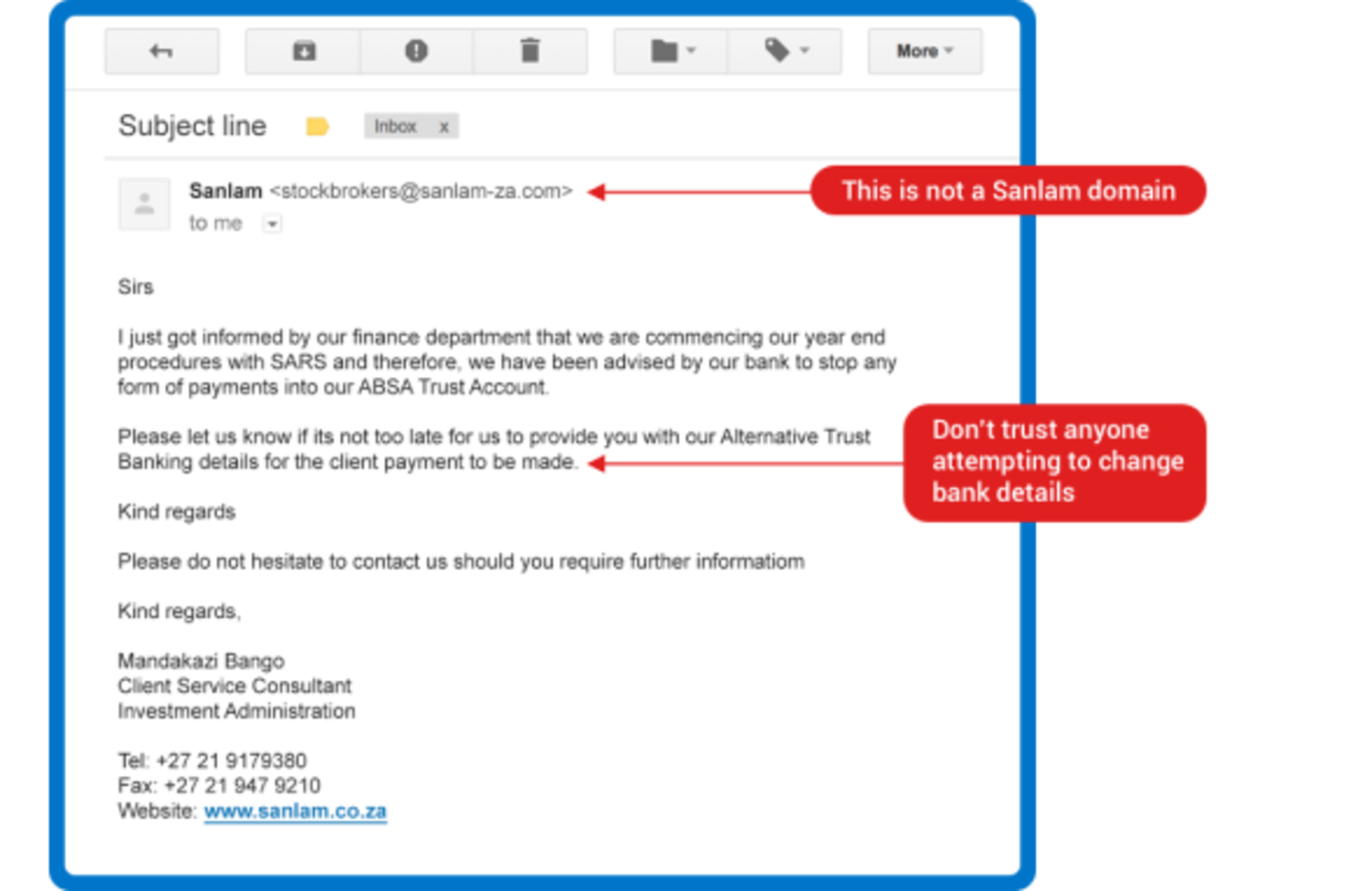

Change of banking details

Individuals claim to be from Sanlam requesting updated bank details. Verify calls from Sanlam by calling 0860 726 526 and not the contact numbers provided during a call.

Vault account

Scammers target older individuals by posing as representatives from a bank's fraud department. They may suggest that you move your money to a 'Vault Account' for a fictitious fraud investigation We would never ask you to send money to any account for safekeeping. Always verify any suspicious instructions by calling 0860 726 526.

Retirement benefit

Fraudsters pose as Sanlam, extracting bank info, including card details and CVV. Never give out these details over the phone. Report any suspicious activity to safeguard against potential fraud.

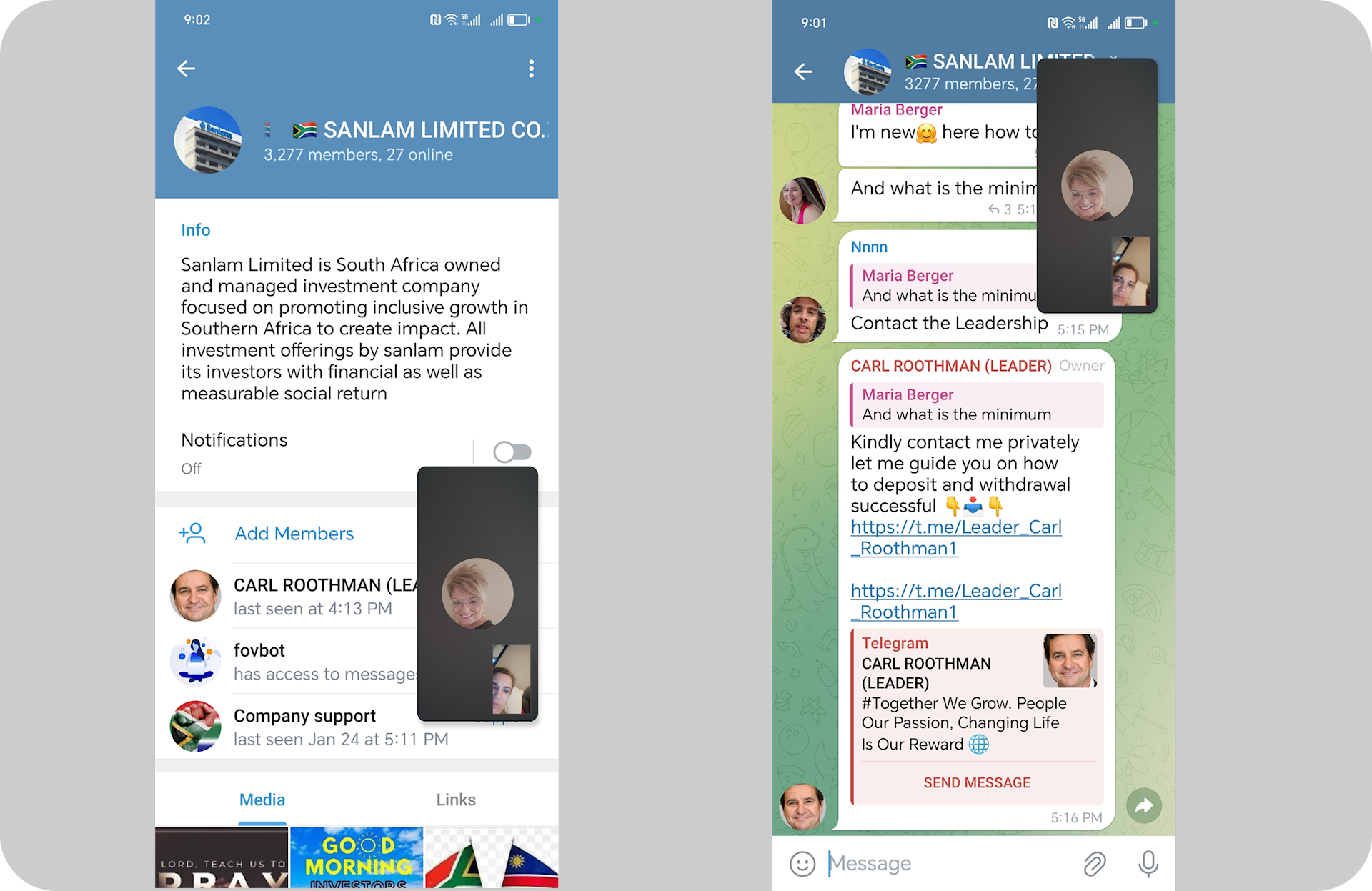

Impersonation of Sanlam on Telegram

A malicious third party is purporting to be or act on behalf of Sanlam through the unauthorised use of Telegram as a communication channel.

Please be informed that Sanlam does not conduct business via Telegram, does not have a Telegram account, and that this is indeed a scam.

Never sharing personal or financial information through unofficial channels

If you are ever in doubt if a channel is official, visit our website on www.sanlamonline.co.za or call 0860 726 526 (0860 SAN LAM)

Never give out a One-Time PIN over the phone

These can be used to gain access to your account

Never share your log in details with anyone

These can be used to access your account

Changing bank account details scam

The "Change of Bank Account Details Scam" is an attempt to get victims to pay money to a fraudulent bank account. Scammers often send an email or letter, pretending to be a legitimate business in an effort to change banking details.

If an email doesn't come from a legitimate Sanlam domain and someone tries to alter banking information, exercise caution and don't trust such requests.

Fake investment & impersonation scam

There is an increase in impersonation scams using WhatsApp, Telegram, Facebook and email. Criminals use AI to copy the voices and faces of Sanlam advisers, executives and even journalists. They create fake investment groups, request payments and then disappear / block the victim. Sanlam will never ask you to invest through chat apps or social media. Sanlam executives will never contact you directly to offer investments. Journalists will never promote or facilitate investments. Always verify with Sanlam or the FSCA, and report impersonation attempts to sanlam@tip-offs.com.

Email hacking scam

Hackers may use phishing or compromised login details to get access to your email account. Once they gain access, they’ll use it to send fake instructions to Sanlam, and erase evidence.

Phishing is a technique scammers use to get sensitive personal information, like banking and login details. There are various methods involved, including sending emails with deceptive links or attachments, and phone calls or messages where they impersonate a trusted business. Sanlam confirms high-risk instructions via phone to prevent fraud.

Resources for staying safe online: