- Features

- How it works

- FAQs

- Get in touch

Choose a tax-free savings account

Returns on your investment are completely tax-free

The longer you invest, the more you benefit from compound growth

Invest R36,000 per year and up to R500,000 over your lifetime

Enjoy flexibility with options for both short-term savings and long-term investment

The power of compound growth

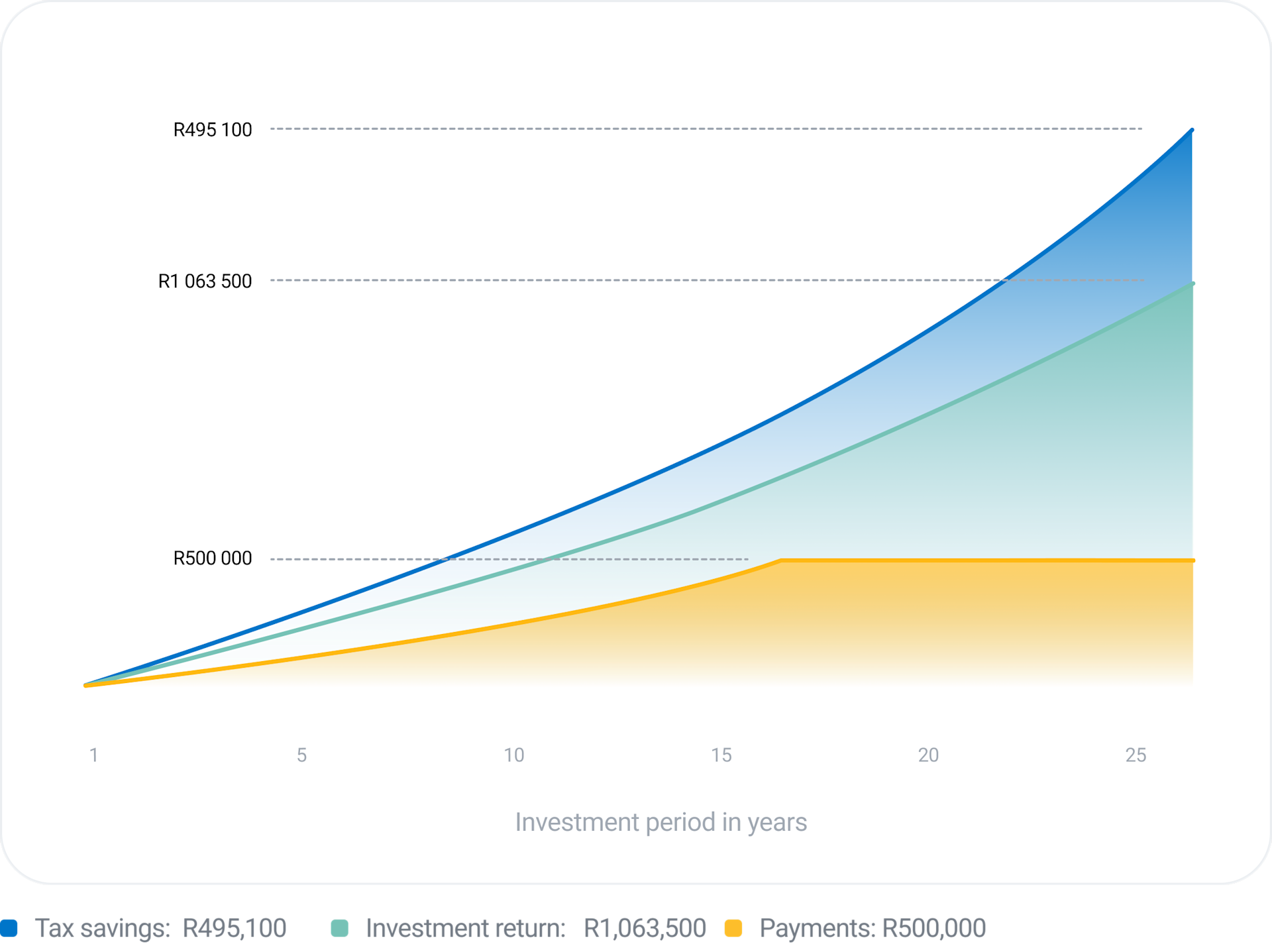

One of the benefits of investing long-term is the power of compound interest, which allows you to earn interest on your interest. By taking advantage of tax-free savings this benefit is effectively doubled, as the taxes you would normally pay are instead added to your savings. This concept is illustrated in the graph, which provides an example based on a monthly contribution of R2,500 over a period of 16 years and 8 months, when the lifetime limit of R500,000 would be reached. The example assumes an investment in a balanced fund with a return of inflation plus 4% per year before fees, and a personal tax rate of 40%. Please note that these values are not guaranteed and are for illustrative purposes only.

Tax-free savings account questions

- Why save in a tax-free savings account?

Your money can grow faster in a tax-free savings account compared to a regular savings account because you don't pay tax on the investment return.

A tax-free savings account is therefore an effective way to save for your goals, because any interest, dividends or capital gains from your tax-free savings account will be free of tax

Saving in a tax-free savings account gives you flexibility as you don’t have to commit to any future contributions. You can withdraw from your investment at any time. Withdrawing funds, however, may prevent you from reaching your savings goals, and will use up part of your lifetime limit for tax-free savings.

- What are the tax benefits of saving in a tax-free savings account?

Contributions to a tax-free savings account are made from post-tax income.

A tax-free savings account is therefore an effective way to save for your goals, because any interest, dividends or capital gains from your tax-free savings account will be free of tax.

No tax is payable on withdrawals.

- How much can I save in a tax-free savings account?

National Treasury has put limits on the amount you can save in a tax-free savings account. The total annual contribution in a tax year may not exceed the annual contribution limit, which is currently R36 000 per tax year. The total lifetime contribution may not exceed R500 000. Make sure you keep track of how much you've paid so that you don't exceed your limit across all approved tax-free savings accounts (at Sanlam or other providers).

- Does the returns on my tax-free savings account affect contribution limits?

No, reinvested returns such as interest, capital gains or dividends do not count towards your contribution limits. The annual or lifetime contribution limits only apply to the amount that you have contributed on your tax-free savings account.

- Can I have more than one tax-free savings account?

Yes, there are no limits to the number of tax-free savings accounts that you can have at Sanlam or other provider. However, make sure you keep track of how much you've paid so that you don't exceed your limit across all approved tax-free savings accounts.

Speak to an expert

ZA

ZABy continuing to the next step, you accept the terms and conditions.

Invest and save

- Invest and save

Save for retirement

Maximise your tax benefit with Sanlam’s retirement solutions and boost your retirement savings with Wealth Bonus.

Retirement preservation

Maintain your existing retirement savings and protect it against the unexpected, like when changing jobs.

Preparing to retire

Generate income with one of three solutions when you’re ready to retire.