Need to talk to someone?

We are here to help you get the information your need. Fill out this form to get a call back or feel free to call us on Weekdays between the hours of 08:00 and 17:00

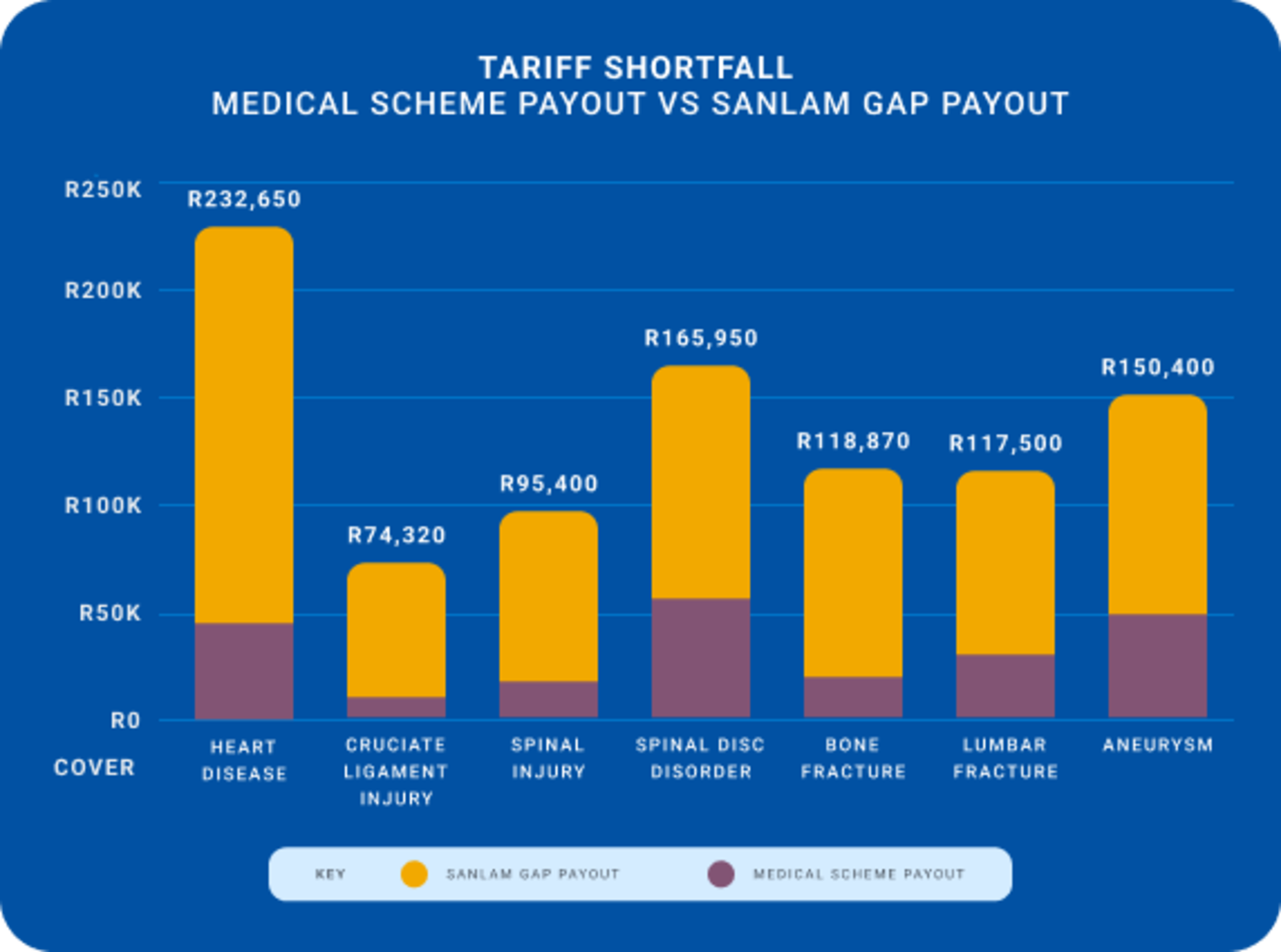

The value of gap cover

Sanlam Gap Cover provides an extra layer of financial protection for those who already have medical aid. It helps to cover certain shortfalls between what your medical scheme will pay, and the rates charged by in-hospital medical specialists. The cost for in-hospital procedures or outpatient treatment can often exceed the base medical aid rate by an additional six times. With Sanlam Medical Gap Cover, you can enjoy peace of mind knowing that you and your family won’t be left to pay a large excess on medical bills. Note: Graph values represent actual payments made by medical aid schemes and gap cover amounts.

Sanlam Comprehensive Gap Cover plan

In-hospital benefits

Tariff shortfalls: Additional six-times medical aid tariff

Sub-limits: R68,500 per event or condition

Co-payments: Unlimited subject to the overall annual limit.

Deductibles: Unlimited subject to the overall annual limit.

Penalty co-payment: A maximum of two events are covered per annum and up to a maximum amount of R18,550 per event, subject to the Key Benefit Limit.

Out-of-hospital benefits

Co-payments: MRI/CT scans: Unlimited. Oncology sub-limits: Limited to statutory maximum of R219,845 per insured per annum.

Accidental Casualty Benefit: Subject to a maximum of R18,450 per event.

Child Casualty Illness: Subject to a maximum of two such events per annum and a maximum of R3,000 per event. Limited to children under age 12.

Hospital Booster

Hospital Booster: A maximum of two hospital episodes are covered per annum, up to a maximum amount of R29,300. The benefit is payable from day one of the hospital episode: R480 per day from the 1st to the 13th day (inclusive). R860 per day from the 14th to the 20th day (inclusive). R1,700 per day from the 21st to the 30th day (inclusive). Max R29,300 per annum.

Family Benefits

Family Booster: R16,900 agreed benefit.

Family Protector: Limited to R20,000 for children below six years. All other insured parties: R30,000.

Additional benefits

Medical scheme and the Sanlam Gap Policy contribution waiver: subject to an overall maximum limit of R40,000.

Dental reconstruction: A maximum of two events are covered per annum, and up to a maximum amount of R49,900 subject to the Key Benefit Limit.

Breast Cancer Reduction Benefit: An agreed benefit amount payable for reconstruction of the unaffected breast following a mastectomy for breast cancer. Agreed benefit amount payable is R30,000 per Insured party over the policy lifetime.

Mediclinic Extender

The Mediclinic Extender Benefit is the perfect add-on to your Sanlam Gap Cover. It offers additional benefits to ensure that you enjoy personalised treatment at all Mediclinic facilities.

Casualty illness: Subject to a maximum of two such events per Annum and a maximum of R3,000 per Insured Event.

Specialist benefit: R5,200 per party per annum.

Private ward: R5,200 per party per annum.

Cancer Agreed Benefit Payout: The benefit is limited to one claim per insured party and is payable only upon a first-time diagnosis of cancer at stage two or higher. The agreed benefit amount is R20,000.

Cashless co-payment: Unlimited number of events, subject to the OAL.

Automated claims process

Our easy claims process means that you don’t have to complete any paperwork for our preferred partners, Fedhealth and Medshield. Any information required is sent directly to Sanlam Gap for assessment by the medical scheme, according to the policy benefits.

Medical provider submits claims to medical scheme for payment

Medical scheme assesses claims and identifies shortfalls

The system sends this onto the administrator for processing

Claims shortfalls are paid within 7 to 14 working days

You’re paid and sent a statement as confirmation.

Find your solution

Individuals under 60 years

Individuals 60+ years

Families (main member under 60 years)

Families (main member 60+ years)

Take a closer look at our cover

In certain cases the cost for in-hospital procedures or outpatient treatment may exceed the base medical aid rate by six times. By taking out Sanlam Medical Gap Cover Insurance, you ensure that you and your family aren’t left with a large excess amount to settle.

When submitting the Claim form, you will need to provide supporting documents as detailed below in the checklist. Claims can be emailed to gapclaims@centriq.co.za. Once received, your Claim will be processed and if all requirements have been met, the Benefit amount will be paid within 7 to 10 working days. Please direct all queries to the Sanlam Gap Service Centre on 0861 111 167.

We require the following documents from you to process your claim:

Claims transaction remittance (receipt) from the medical scheme.

Relevant doctors’ accounts.

Hospital account (the first four pages showing admission/discharge times and ICD codes).

Current medical scheme membership certificate (copy of the membership card is not accepted).

An e-mail and SMS is sent to the member when:

The claim is captured.

Outstanding documentation is requested (assuming you have not signed the authority form).

The claim is authorised.

Please note that payments will be made directly into the principal member’s bank account.

You need to be an existing member of a registered medical aid scheme.

Gap cover extends to the principal member, their spouse and children until they reach the age of 27. Families covered on two medical aids will be covered by a single Sanlam Gap Cover policy.

Special dependants may be included (excluding financially dependent parents).

Yes, the following waiting periods apply:

A general waiting period of three months on all benefits.

A 12 months condition specific for pre-existing conditions for which you received advice, treatment or diagnosis during the 12 months prior to the cover commencing.

Please refer to our Policy Document for 2026 (Section G) for more information.

Treatment for obesity, including bariatric surgery (stomach stapling).

Treatment for cosmetic surgery unless necessitated by a trauma or as a result of oncology treatment (e.g. breast reconstruction following a mastectomy).

Specialised dentistry is only paid for on the Sanlam Gap Cover Comprehensive Plan in the event of trauma, cancers and tumours.

Claims older than six months.

Any claim that is excluded or rejected by the insured’s medical scheme.

Please refer to our Policy Document for 2026 (Section I) for more information.

Need to talk to someone?

We are here to help you get the information your need. Fill out this form to get a call back or feel free to call us on Weekdays between the hours of 08:00 and 17:00