Budget 2025: Still in Pursuit of Debt Stabilisation

The new Government Budget for 2025 was tabled on 21 May 2025. Fiscal consolidation remains the central theme, with a combination of spending cuts and revenue raising measures roped in to stabilise and, ultimately, lower the government’s debt ratio over the medium term. The debt trajectory is, nonetheless, higher than previously projected by the Treasury, given downward revisions to GDP forecasts. This serves to illustrate the ongoing challenge of fiscal consolidation in a low growth environment.

The emphasis on infrastructure spending is maintained but expenditure risks still lurk and a decrease in the ratio of non-interest spending to GDP is delayed to the outer years of the medium-term framework. The cornerstone of fiscal consolidation remains a projected improvement in the primary budget balance. However, the tax-to-GDP ratio increases over the medium term, although the hope is that additional allocations to SARS will extend the nascent improvement in tax administration and obviate the need for future (currently unspecified) tax increases.

Improving primary budget balance as the cornerstone for fiscal consolidation

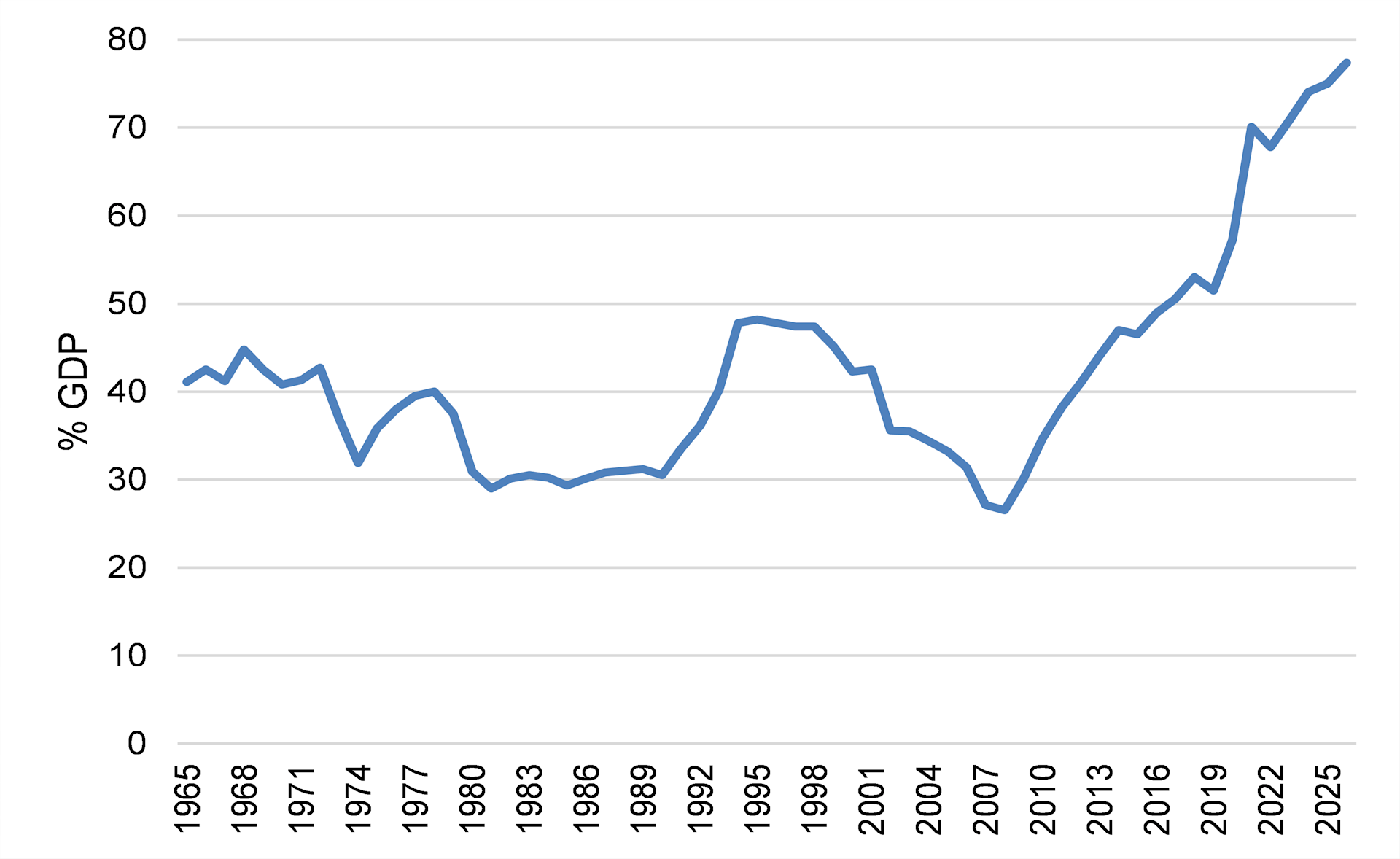

Gross loan debt is now expected to peak at 77.4% of GDP in 2025/26, from 76.9% in 2024/25. This is higher than the previous projection of 76.2% of GDP for 2025/26 published in the defunct March 2025 Budget. It reflects a lower level of nominal GDP, given the downward revision to the Treasury’s GDP growth forecast, as well as a higher estimate for 2024/25. Over the medium term, the debt ratio eases to 76.7% of GDP by 2027/28, as the main primary budget surplus (revenue less non-interest spending) improves from +0.8% of GDP in 2025/26 to 2.1% of GDP by 2027/28.

The government’s gross borrowing requirement for 2025/26 is lower at R588.2 billion than the March 2025 projection of R581.96 billion. Gross domestic long-term loan issuance is marginally higher, though, at R345.3 billion compared with the March projection of R343.2 billion. Looking ahead, the gross borrowing requirement decreases to R434.3 billion in 2026/27, before increasing to R587.7 billion in 2027/28, in part due to large redemptions of R301.2 billion.

Gross loan debt ratio to end 2025/26

Source: SA National Treasury, Sanlam Investments

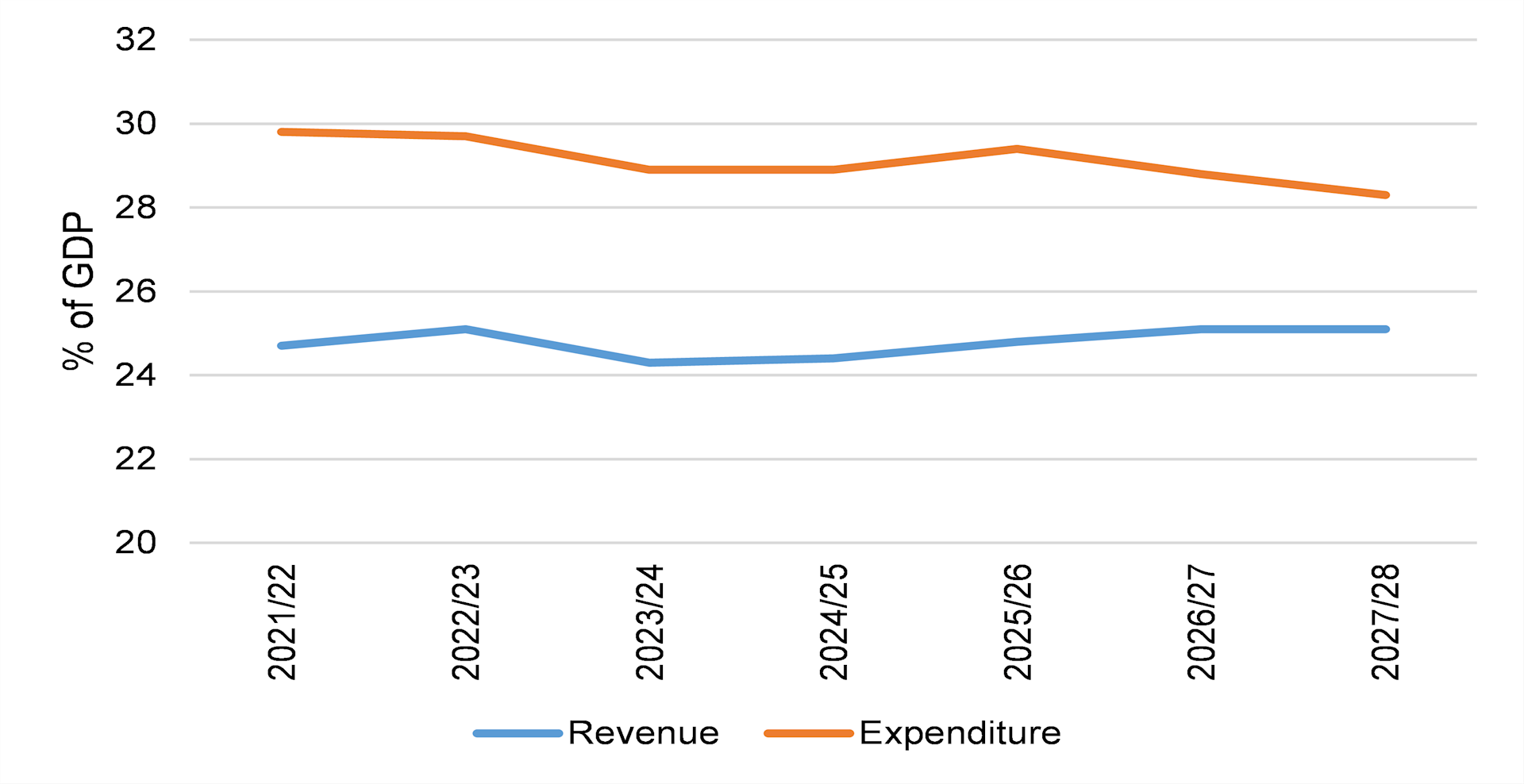

The tax-to-GDP ratio is revised higher over the medium term

To help achieve the required improvement in the primary budget balance, the tax to GDP ratio increases from 25.0% of GDP in 2024/25 to 25.7% of GDP by 2027/28.

Due to the withdrawal of the VAT hike proposal and downward revisions to growth forecasts, tax revenue projections were revised lower by R61.9 billion over the next three years relative to the March 2025 estimate. Specified new revenue raising measures “net” the fiscus R18 billion in 2025/26, while providing R1 billion in relief in 2026/27. An additional unspecified R20 billion in new revenue raising measures will be announced in Budget 2026. Since VAT is now likely off the table for a few years, the emphasis for future tax increases is likely to fall on direct income tax, which reduces the incentive to work and invest.

However, it is hoped that an additional allocation to SARS of R7.5 billion over the next three years (incorporating the additional allocations in the 2024 MTBPS and the May 2025 Budget) will improve tax administration further and obviate the need to introduce the mooted new tax-raising measures next year. The estimate for the potential new revenue from improved tax collection ranges from R30 billion to R50 billion per year.

The additional zero-rating of items, which accompanied the previously proposed VAT rate hike, falls away. Further, for the current fiscal year there is no inflationary adjustment to tax brackets, rebates and medical tax credits for individuals, as proposed in the now defunct March 2025 Budget. This “nets” the fiscus R16.7 billion in 2025/26 and a cumulative R53.2 billion over the medium term. Above inflation increases in excise duties on alcohol and tobacco net the fiscus R1.3 billion this year (compared with R1 billion projected in March 2025). In addition, an inflationary increase is proposed for the general fuel levy. This implies a neutral outcome for the fiscus relative to the drain of -R4 billion projected previously in March 2025.

Main budget revenue and expenditure

Source: SA National Treasury

Spending cuts mainly focussed on the outer years of the medium-term framework

The new version of the Budget indicates Main Budget non-interest expenditure increases by a cumulative R74.4 billion over the medium term relative to the 2024 Budget projections. However, total Main Budget spending still increases from 28.9% of GDP in 2024/25 to 29.4% of GDP in 2025/26, before decreasing to 28.3% of GDP in 2027/28. Hence, consolidation is reserved for the outer years of the medium-term framework.

Additions to baseline and provincial allocations relative to Budget 2024 amount to a cumulative R180.1 billion over the medium term. This is lower than the additional allocations of R232.6 billion initially announced in the defunct March 2025 Budget. Amongst theadditional baseline and provincial allocations, the allocation to infrastructure spending is R33.7 billion (lower than the R46.7 billion announced in March 2025). The increased costs related to the government wage bill and incentives for early retirement announced in March 2025 are retained. So, too, is the Social Relief of Distress Grant, which has been extended up to the end of the current fiscal year. Thereafter, the government aims to integrate this grant with employment opportunities, potentially including a job-seeker allowance.

At the same time, additional allocations related to above inflation increases for social grants are reduced relative to the March 2025 estimate. Further, additional provisional allocations for frontline services are reduced from the R70.7 billion announced in March 2025 to R41.3 billion. Other spending allocations, which include, but are not limited to PRASA and defence personnel deployment in the DRC, are reduced from the March 2025 projection of R37.5 billion to R35.5 billion.

As regards spending cuts relative to the Budget 2024 projections, the reduction in provisional allocations is increased from the -R66.7 billion announced in March 2025 to -R81.8 billion over the next three years, while the contingency reserve is decreased by a cumulative R21.3 billion (unchanged from the March 2025 estimates). Technical adjustments amount to -R-2.6 billion (unchanged from the March 2025 estimates).

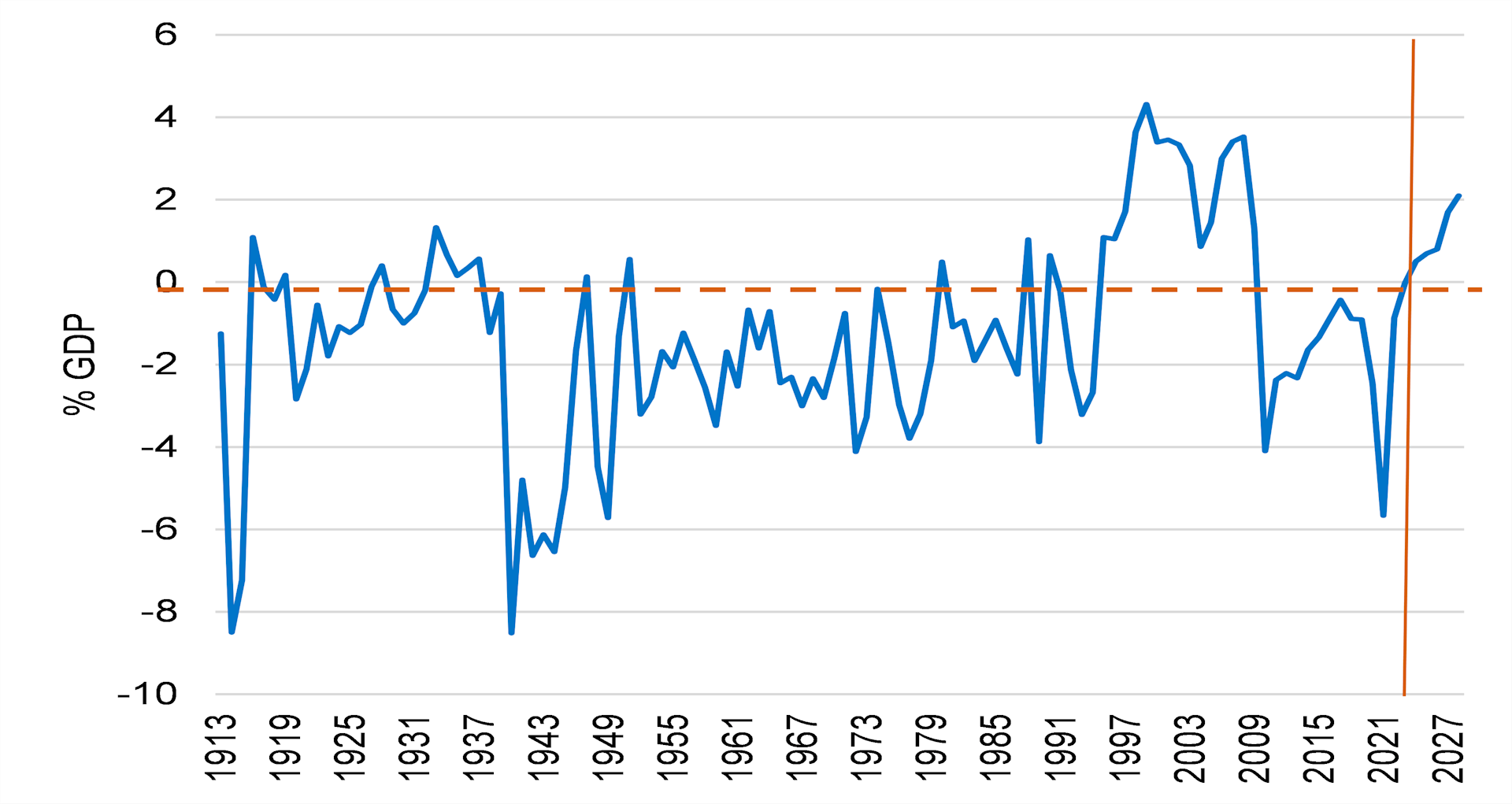

Sustained large primary budget surpluses are rare

Source: SARB and SA National Treasury projections

Minister Godongwana noted expenditure reviews have looked at R300 billion in government spending since 2013, identifying savings of R37.5 billion. The Treasury is committed to closing underperforming programmes, while a data-driven approach is to be employed to detect payroll irregularities. That said, expenditure risks lurk, given high unemployment-related spending demands, as well as the forthcoming implementation of NHI (although timing of the latter is vague). Also, additional funds are likely to be sought for the loss of PEPFAR funding, infrastructure projects in the Budget Facility for Infrastructure, and PRASA (for the rolling-stock fleet renewal programme). As regards Transnet, though, a government guarantee is being considered to assist with the refinancing of maturing debt and to support the capital investment programme.

Encouragingly, there is still a strong emphasis on infrastructure spending as total public infrastructure spending exceeds R1 trillion over the medium term, including R402 billion for transport and logistics, while R219.2 billion is to be invested in the electricity supply network, including generation, transmission and distribution. Further, R156.3 billion is to be spent on water and sanitation. To help facilitate infrastructure investment, new regulations have been gazetted to reduce the procedural complexity around PPPs, while the Budget Facility for Infrastructure remains the main vehicle through which large infrastructure projects take place. An infrastructure bond is also planned. In addition, the government is considering alternative financing instruments to allow pension funds, commercial banks, development banks and international financial institutions to fund infrastructure.

Our debt trajectory view

Our base case has consistently shown an increase in the government’s gross loan debt ratio over the medium term, albeit a relatively flat trajectory since we incorporate additional expenditure risks. Although the National Treasury’s intent cannot be faulted, the medium-term outlook for the debt trajectory is still at risk. In the past 100 years, sustained significant primary budget surpluses have been rare. Ultimately, until growth lifts, to reduce unemployment, spending demands for an increased safety net and other support measures are expected to remain high, so that the fiscal math doesn’t add up.