Need to talk to someone?

- Financial planning

- Financial check

- Financial tools

- Money personality

- Get in touch

Plan with financial confidence

A good plan will help you to become financially secure and make better money choices. Get a roadmap that’ll help you to plan how you’ll achieve financial goals, like saving for retirement and big purchases, or trying to manage debt.

Getting married

Marriage is a big milestone. Prepare for your shared future with the right support and financial advice.

Buying a house

Discover the keys to homeownership. Navigate the journey to your new home with confidence.

Having a baby

Any parent will tell you that having a baby changes everything. Make sure you have the tools and solutions you need to take it all on.

Starting your career

With your first pay cheque comes your first step towards financial freedom. Becoming independent means thinking and planning ahead for your future.

Explore financial planning tools

Learn more about managing your finances and use our calculators to help plan your financial needs.

- calculators

Saving for retirement

Retirement should be something to look forward to. Use this tool to see if you're saving enough to retire comfortably.

Understanding income tax

Calculate your annual and monthly income tax deductions using the new tax scales and compare them to last year's.

Saving for education

Give your children a brighter future by finding out how much to invest in our education savings plan or a unit trust.

Why your Money Personality matters

Your relationship with money shapes the way you save, spend, and plan for the future. And your Money Personality can provide valuable insights into your financial habits, strengths, as well as identify potential blind spots. Our AI-powered platform will guide you towards understanding your unique approach to money, all through a quick conversation.

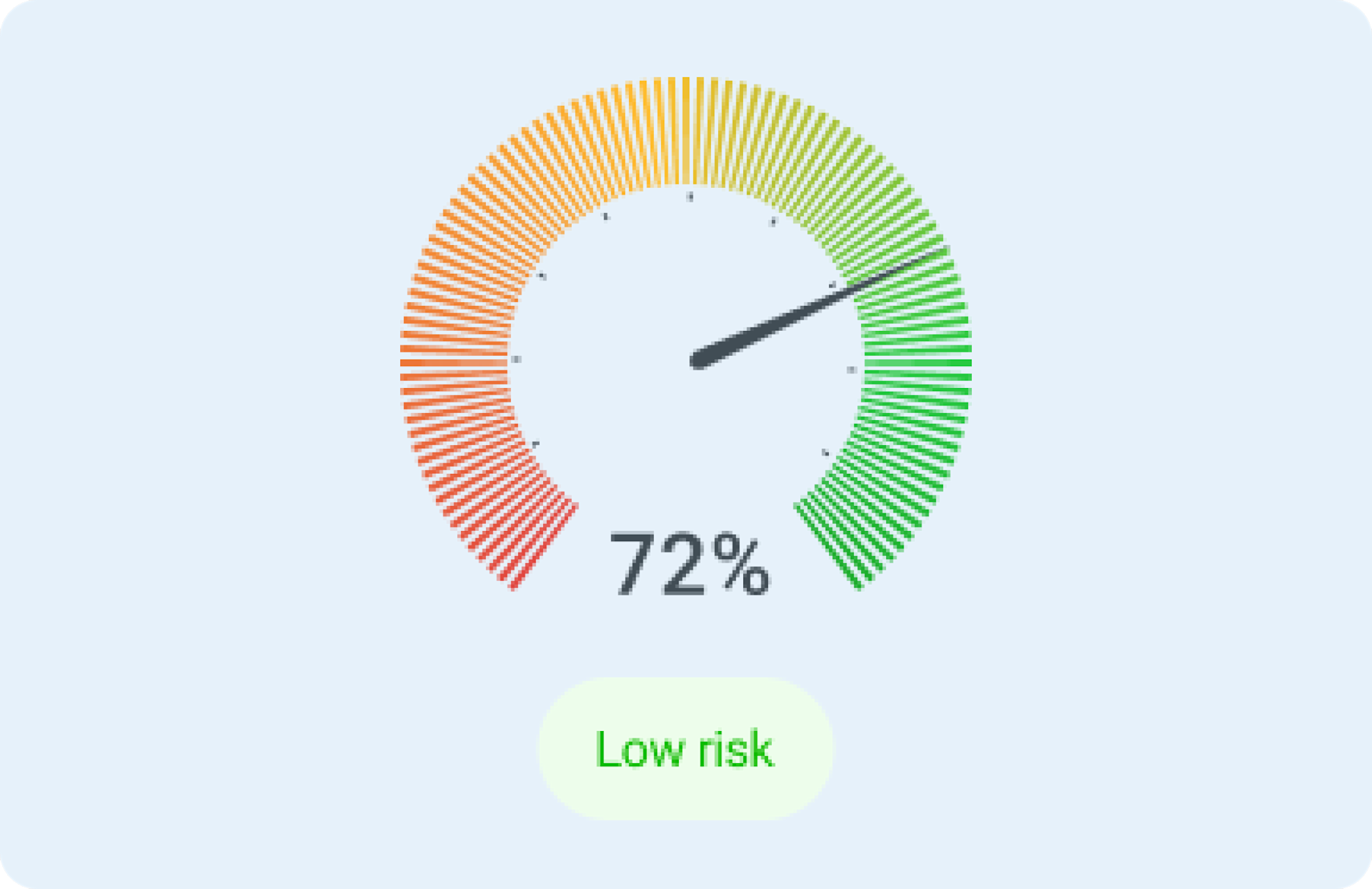

Keep your credit score on track

Sanlam's credit health dashboard will help you to stay on top of your finances and keep track of your credit score to help you financially prepare with confidence.

Credit dashboard features:

Keep your accounts secure by monitoring for suspicious activity

Speak to a credit coach and use our budget tool to track your spending

Track your account activity, interest rate payments and account fees

Explore suitable financial products

Let's talk about finances

Short, medium and long-term savings and investment needs

Income and expenditure

Appetite for risk and how it can impact your savings

Understanding of what your financial plan will cost you

Need anything else?

Wills

Ensure that your wishes are carried and protect your legacy by drafting a will online.

Draft and store your will at no cost

Peace of mind from recording your final wishes

Expert help to finalise and execute your will

Sanlam Legacy Plan

Cover up to 100% of legal fees associated with estate planning fees.

Flexibility to choose any executor

Provide financial security for loved ones

Create the perfect legacy plan for your family

Credit Life Cover

Ensure that your large debts are paid when your income is affected.

Personalise your cover with an adviser

Death or permanent disability cover

Retrenchment cover